7 Accounting Career Paths — Entry-level to Senior Roles

What could your future look like in an accounting career? There are a range of different accounting career paths you can take if you’re looking to step into the field and grow within it. It’s an ideal field for people who are detail-driven and great with numbers.

People with accounting expertise work across all industries. You can fight crime as a forensic accountant, play an integral role in ensuring that a non-profit organisation is making maximum impact, or be in charge of the financial operations of a large company. You can help organisations big and small.

You can also choose how to work. You could work for yourself as a freelancer, contractor, or consultant; as part of an organisation’s accounting or corporate services team; or as part of an accounting firm offering services to other organisations.

Career paths in accounting

Accounting clerk

An accounting clerk assists accountants with their administrative tasks, for example:

- Sorting and mailing invoices

- Keeping records of business transactions

- Keeping track of refunds,

- Monitoring credit and debtor accounts

- Making calculations about operational costs

It’s a supportive role which allows you to see first-hand how business works.

Accounting clerks do not require any formal qualifications but vocational training in areas like accounting, bookkeeping, business administration, and/or secretarial/clerical work are likely to be useful.

This position has stable future growth, and around 66% of those with this job title work full-time.

Bookkeeper

Bookkeepers commonly work with business owners or managers to help them make financial decisions and keep track of their business activity. They:

- Process and record financial transactions and cash flow

- Manage payroll systems

- Produce financial documents such as income statements and balance sheets

- Reconcile financial records against bank statements

- May play a role in fulfilling organisational tax requirements.

It’s a role that takes you into the nitty gritty of the daily finances of an organisation.

Find out the difference between bookkeeping and accounting.

You can work as a bookkeeper without formal qualifications, although it is useful to have training or experience in business finance or administration to show potential employers that you understand the processes involved.

Bookkeeping as a profession is expected to have stable growth. 33% of those in the industry work full-time, so there are plenty of part-time roles for those with family commitments or otherwise seeking work/life balance.

Payroll clerk

Payroll clerks are specifically involved in preparing payrolls and related records so that organisations can meet their statutory requirements, and so that everyone gets paid!

You can become a payroll clerk without formal qualifications, although it can be useful to have vocational training in accounting, bookkeeping, business management, or human resources.

It’s expected that there will be stable future growth for payroll clerk positions. Around 66% of people work full-time in this role.

Accountant

Accountants analyse, interpret, and report on financial matters for organisations or individuals. It’s a highly analytical role which allows people to understand their own or their organisation’s financial position and make key decisions on that basis.

As an accountant, you can work in one of many sub-fields, including:

- Tax accountant.

Specialising in complex tax law and procedure, tax accountants help people and businesses minimise their tax burden and ensure they’re compliant with regulations. - Financial accountant.

These professionals focus on examining a business’s performance for external clients in order to optimise decisions about whether to give a loan, invest in a business, or undertake regulatory action. - Management accountant.

Management accountants work within a business to report on financial information for executive and board members. Their reports are used to optimise business performance and maximise profits. - Forensic accountant.

This type of accounting involves preventing and investigating financial crimes like fraud, tax evasion, and money laundering. They do this by analysing individual and business financial information like bank statements, spreadsheets, and reports. - Auditor.This sub-speciality of accounting is involved with making sure that financial records are reliable, that there’s no missing information or dodgy transitions, and that corporate systems are secure.

- Accounting information systems accountant.

Accounting isn’t all abacuses and ledger paper — a lot of the work of storing and processing financial data is conducted with complex computer software. Accountants specialising in information systems manage and train people in using those systems, ensuring that they’re kept up-to-date and that the processes stay accurate.

At a minimum, accountants must earn a Diploma of Accounting, however training in accounting to a bachelor degree level is typical. Some of the specialities listed above may require specific professional development, or even masters degree-level training.

To work as an accountant, you’ll also need to register with one of three peak Australian accounting bodies, for instance by becoming a CPA. Registration involves completing specialised tests and requires you to build a wide range of skills.

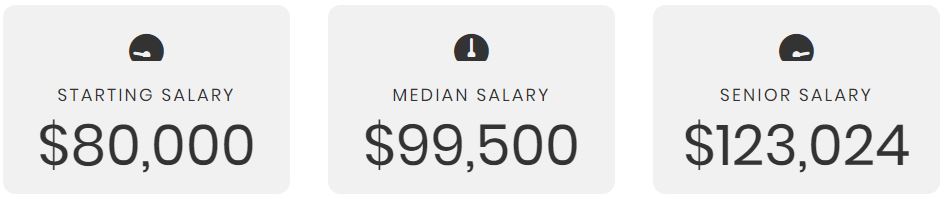

Different specialities within accounting will attract different pay scales, but in general, accountants can expect to earn:

Corporate services manager is a role with moderate expected future growth, with 87% of workers in full-time positions.

Company secretary

Company secretaries play a key role in administering an organisation. They make sure that an organisation meets its regulatory requirements so that they aren’t fined or otherwise reprimanded.

This role requires a high level of legal and financial knowledge and risk management. They make sure that business under discussion is recorded in the form of minutes, and ensure that decisions are made appropriately with policy and procedures being followed. They then prepare and send reports to the board, and, similar to an auditor, and ensure that financial records are true and reliable.

It’s a huge level of responsibility, but integral to ensuring that the business of an organisation can legally continue and is done well.

Usually a bachelor’s degree in a relevant field such as accounting, commerce, finance, or law will be expected of company secretaries. Previous experience in regulatory roles, like auditing, is useful.

As a role, company secretary has strong future growth and 86% of company secretaries work full-time.

Corporate services manager

Corporate services managers are involved with coordinating an organisation’s day-to-day administrative tasks. You’ll be:

- Managing staff, finances, and resources

- Undertaking budgeting and making financial projections

- Developing organisational policies so that work is a safe and productive environment.

Although it is possible to work up the corporate ladder and gain experience in related roles that do not require any particular qualification, it is typical to hold a university degree in accounting, business, human resources, or commerce.

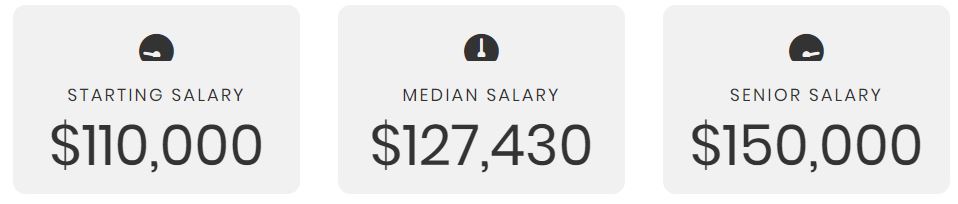

Corporate services manager is a high paying profession.

As a role, company secretary has strong future growth and 86% of company secretaries work full-time.

Finance manager

Finance manager is a high-level role within an organisation involving the coordination of all financial and accounting activities. Job titles also include Chief Financial Officer, Finance Director, or Financial Controller.

You’ll be in charge of making and delivering a corporate strategy, making business and financial decisions, managing people, implementing accounting systems, and overseeing financial reporting.

Most people in these roles will have university-level qualifications in accounting, commerce, or business. They’ll also have years of industry experience and proven success in managing people and finances.

As a role, company secretary has strong future growth and 86% of company secretaries work full-time.